Why a Hard Cash Lending Might Be the Right Choice for Your Following Investment

Get in tough cash loans, a tool that focuses on swift approval and funding, as well as the home's value over a borrower's credit scores history. Regardless of their potential high expenses, these car loans can be the secret to unlocking your next financially rewarding deal.

Comprehending the Basics of Hard Cash Car Loans

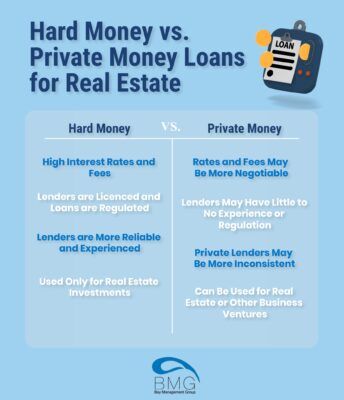

While traditional financings may be familiar to most, understanding the fundamentals of difficult money car loans is crucial for prospective capitalists. Hard cash fundings are a type of short-term financing where the investor protects the Funding with actual estate property as collateral. Lenders are typically personal companies or people, making the Lending terms and rates more versatile than standard financial institution lendings.

The Advantages of Choosing Tough Money Loans

Prospective Drawbacks of Hard Cash Fundings

Regardless of the benefits, there are likewise prospective disadvantages to take into consideration when dealing with difficult cash fundings. Hard view it money financings are typically temporary fundings, generally around 12 months. These factors can make hard cash car loans much less eye-catching for some capitalists.

Real-Life Scenarios: When Tough Cash Lendings Make Feeling

Where might hard cash finances be the suitable monetary service? Actual estate capitalists looking to take a time-sensitive possibility may not have the high-end to wait for traditional bank financings.

Here, the hard money Financing can fund the renovation, enhancing the residential or commercial property's worth. Hence, in real-life circumstances where rate and adaptability are crucial, difficult cash car loans can be the perfect option (hard money lenders in atlanta georgia).

Tips for Navigating Your First Hard Money Financing

How does one efficiently browse their first difficult money Finance? Make sure the investment residential property has possible revenue sufficient to produce and cover the Funding income. Hard money financings are short-term, typically 12 months.

Verdict

In final thought, hard money fundings offer a fast, versatile funding option genuine estate investors seeking to maximize time-sensitive chances. Regardless of possible downsides like greater passion rates, their convenience site of access and concentrate on property value over credit reliability make them an attractive choice. With careful factor to consider and audio investment techniques, difficult money lendings can be an effective tool for making the most of returns on temporary projects.

While conventional fundings may be acquainted to most, comprehending the fundamentals of hard money finances is vital for potential capitalists. Hard cash fundings are a kind of short-term financing where the investor protects the Finance with real estate home as collateral. Lenders are generally personal business or people, making the Finance terms and prices even more versatile than standard financial institution loans. Unlike traditional bank loans, hard money lenders are largely more worried with the value of the residential property and its potential return on financial investment, making the approval procedure less rigorous. Tough money lendings are usually short-term fundings, usually around 12 months.